CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Tax Treaties

- Vaid's ICS, Lucknow

- 30, Mar 2022

Why in News?

- A tax treaty is a bilateral two-party agreement made by two countries to resolve issues involving double taxation of passive and active income.

- Tax treaties generally determine the amount of tax that a country can apply to a taxpayer’s income, their capital, estate, or wealth.

- A tax treaty is also called a Double Tax Agreement (DTA).

- When an individual or business invests in a foreign country, both countries – the source and the residence countrymay enter into a tax treaty to agree on which country should tax the investment income to prevent the same income from getting taxed twice.

- To avoid double taxation, tax treaties may follow one of two models:

OECD Tax Model – The OECD Tax Convention on Income and on Capital requires the source country to give up some or all of its tax on certain categories of income earned by residents of the other treaty country. The two involved countries will benefit from such an agreement if the flow of trade and investment between the two countries is reasonably equal and the residence country taxes any income exempted by the source country.

U.N. Tax Treaty Model – Formally referred to as the United Nations Model Double Taxation Convention between developed and developing Countries. This favorable taxing scheme benefits developing countries receiving inward investment. It gives the source country increased taxing rights over the business income of non-residents compared to the OECD Model Convention.

Tax information exchange agreements (TIEA):

- A TIEA is a mutual agreement between countries that is a tax treaty variant specifically entered into by governments to exchange information relevant to the administration and enforcement of the domestic tax lawsof the contracting parties.

- The key purpose of this arrangement is to promote international cooperation in tax matters by exchanging tax related information (including that of banking and ownership).

- The OECD is the original proponent of TIEAs.

- They were developed by its Global Forum Working Group on Effective Exchange of Information to address harmful tax practices.

- The TIEA is based on international standards of tax transparency and enables the sharing of information on request.

- The agreement also provides for representatives of one country to undertake tax examinations in other countries.

- However, TIEAs are not binding instrumentsand can be terminated as stipulated in the agreements.

Advance pricing and transfer pricing:

- The Advance Pricing Agreement (APA) was introduced in 2012 by the Central Board of Direct Taxes(CBDT) with an aim of minimising any confusion regarding the pricing of international transactions.

- APA guidelines were included as part of the Income Tax Act, 1961 and rules 10F to 10T and rule 44GAwere inserted in the already existing income tax rules.

- It is an agreement between a taxpayer and a tax authority fixing the transfer pricing methodology to decide the pricing of future international transactions of the taxpayer.

- Once the APA is sealed, the methodology decided upon is applied for a certain period of time based on completion of certain terms and conditions.

Benefits:

- It checks tax evasion.

- Following the APA guidelines removes the threat of audit for an enterprise taxpayer who has business across several countries.

- Reduces the cost of administration of tax authorities and removes extra pressure on their resources.

- It brings in more transparency and clarity for a taxpayer in terms of tax risks and possible exposure to such risks.

- APAs also declare successful settlement of existing transfer pricing disputes.

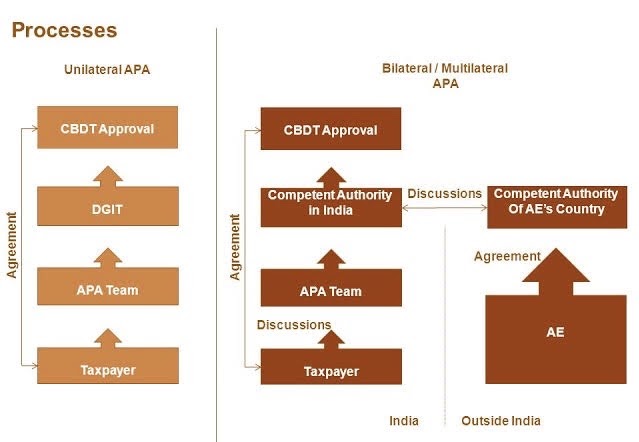

Types of APA:

- Unilateral APA

- Bilateral APA

- Multilateral APA

Transfer Pricing:

- It is the charge at which one company makes available goods or finance or services to another company that is related to it.

- The idea behind transfer pricing is that all transactions between associated enterprises or related companies should be based upon the same terms (at an Arm’s length) and conditions as those between unrelated parties.

- This Arm’s Length principleis an internationally accepted principle, accepted by domestic tax legislation of almost all countries worldwide.

Tax agreements under BRICS and its relevance for India:

- At the meeting of tax heads of BRICS nations, India has voiced for wider sharing of information exchanged under tax treaties among BRICS countries.

- It also underlined the need to tax emerging business models using digital mediums.

- It is very much needed for countering corruption, money laundering and terrorist financing.

- India has called for adopting a “whole of government approach”in dealing with cross border financial crimes, as they have ramifications in respect of various statutes, not only taxation.

- India also asked for sharing of Covid-19 related tax measurestaken by respective tax administrations.

- This move is to enhance the country’s understanding of the fiscal and economic impact of the pandemic.

- The knowledge sharingwould also aid in further evaluating various possibilities in assisting the government’s efforts in containing the pandemic.

Facts for Prelims:

Black Rock Android Malware:

Recently, a security firm has alerted about a new malware called BlackRock which targets social, communication, and dating apps.

Key Points

- BlackRock is abanking Trojan and said to be an enhanced version of existing Xerxes malware which itself is a variant of the Loki Bot Android trojan.

- A trojanis any type of malicious program disguised as a legitimate one. Often, they are designed to steal sensitive information (login credentials, account numbers, financial information, credit card information, and the like) from users.

- Banking trojans are a specific kind of trojan malware. Once installed onto a client machine, banking trojans use a variety of techniques to create botnets, steal credentials, inject malicious code into browsers, or steal money.

Functioning:

It collects user information by abusing the Accessibility Service of Android and overlaying a fake screen on top of a genuine app.

- It uses Android DPC (Device Policy Controller) to provide access to other permissions.

Minervaria Pantali Frog Species:

(Minervarya Pentali)

Recently a new species of frog has been discovered in the Western Ghats and this species is endemic to the Southern Western Ghats (Kerala and Tamil Nadu).

- This species is one of the smallest known ‘Minervaria’ (species) frogs.

- The new frog species is related to the ‘Dicroglossidae’ family.

- To support and encourage the establishment of the Systematics Lab in the University of Delhi for naming this species, Prof. Named after ‘Deepak Paintal’