CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

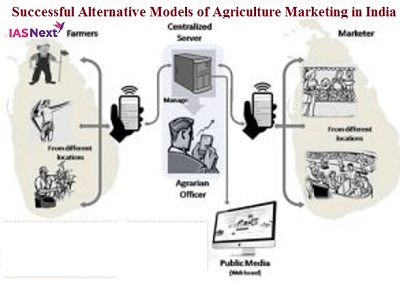

Successful Alternative Models of Agriculture Marketing in India

- IAS NEXT, Lucknow

- 13, Jan 2021

Some other Innovative Marketing Mechanisms

Some innovative marketing mechanisms have been developed in some states, which involve the direct sale of farm produce to consumers, the sale of produce to buyers without routing it through mandis, and group marketing. Many states have attempted to promote direct contact between producers and consumers by making arrangements for sale at designated places in urban areas.

Farm producers’ organisations (FPOs) of various kinds are emerging as a new model for organised marketing and farm business. Such models include informal farmers’ groups or associations, marketing cooperatives and formal organisations like producers’ companies. Producers can benefit from getting together to sell their produce through economies of scale in the use of transport and other services, and raise their bargaining power in sales transactions, while marketing expenses get distributed. This results in a better share of net returns. Such models are particularly required for small farmers to overcome their constraints of both small size and modest marketable quantities.

Organised Retail Outlets: The direct purchase of farm produce by retailers has been steadily increasing with the growth of organised retailing in India. This is expected to accelerate if the entry of foreign direct investment (FDI) to the field is allowed further.

Food World (of the RPG group) is the leader among organised food retail chains, and there are many more such as Fab Mall, Monday to Sunday, Family Mart, More for You, Heritage, Reliance Fresh and Big Bazaar.

Most food chains are regional in nature, having one or two outlets in the main cities, but no big presence outside their states. Rapid urbanisation, urban population growth, increase in incomes and consumer spending, changing lifestyles, and access to technology have been the important factors behind the expansion of food retail chains in India. Despite several factors favouring organised retail trade, it is still in a nascent stage in the country.

Crop Insurance in India

PM Fasal Bima Yojana: An Analysis

The PMFBY is in line with the concept of the ‘one nation one scheme’ theme. The purpose of PMFBY is to remove the shortcomings of the previous agriculture insurance schemes and incorporates the best features of previous insurance schemes. The PMFBY has replaced the National Agricultural Insurance Scheme and Modified National Agricultural Scheme. The PMFBY has been introduced with the following objectives:

- To provide insurance coverage and financial support to the farmer in the event of crop failure or any natural calamity

- To stabilise the income of the farmers

- To encourage farmers to undertake innovative and modern agricultural practices

- To ensure flow of credit to farmers

Features of the scheme

- The Scheme covers all Food & Oilseeds crops and Annual Commercial/Horticultural Crops.

- The scheme is compulsory for loanee farmers obtaining Crop Loan /KCC account for notified crops. However, it is voluntary for other/non loanee farmers who have insurable interest in the insured crop.

- The scheme provisions have been simplified for easy understanding and the Maximum Premium payable by the farmers will be 2% for all Kharif Food & Oilseeds crops, 1.5% for Rabi Food & Oilseeds crops and 5% for Annual Commercial/Horticultural Crops.

- The difference between premium and the rate of insurance charges payable by farmers shall be shared equally by the Centre and State.

- The Scheme shall be implemented on an ‘Area Approach basis’. The unit of insurance shall be Village/Village Panchayat level for major crops and for other crops it may be a unit of size above the level of Village/Village Panchayat.

- Claims for wide spread calamities are being calculated on area approach. However, losses due to localised perils (hailstorm, landslide & inundation) and Post-Harvest losses due to specified perils, (cyclone/cyclonic rain & unseasonal rains) shall be assessed at the affected insured field of the individual insured farmer.

- There is no upper limit on government subsidy. Even if balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgo on the premium subsidy. This capping has now been removed and farmers will get claims against full sum insured without any reduction.

- The use of technology will be encouraged to a great extent. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

Table 1: A Comparison of PMFBY and other Insurance Schemes

| Parameters | NAIS | MNAIS | PMFBY | Improvements, if any. |

| Farmers Covered | All farmers including sharecroppers and tenant farmers growing the notified crops in the notified areas were eligible for coverage. Scheme was compulsory for farmers availing crop loans and voluntary for others | Same as NAIS | Same as NAIS | The coverage of farmers has remained the same. |

| Risks Covered | All yield risk | All yield risk plus sowing failure covers (localised risk like pest diseases etc) | Same as MNAIS | No improvement over MNAIS |

| Crops Covered | Food crops, Commercial crops, Horticulture crops | Same as NAIS | Same as NAIS | The crops covered has remained the same. |

| Insurance Unit | Unit area of insurance may be a gram panchayat, mandal, hobli, circle, phirka, block, taluka, etc. | Unit area to be reduced to village / village panchayat or other equivalent unit for all crops. | Ordinarily insurance unit to be village / village panchayat for major crops and higher than village/village panchayat like block, taluka for other crops. | A combination of both NAIS and MNAIS is used for insurance unit. |

| Threshold Yield | Average of last three years for wheat and rice and five years for other crops multiply by indemnity level | Average of last seven years excluding maximum two calamities years for all crops multiply by indemnity level | Same as MNAIS | No improvement over MNAIS |

| Sum Insured |

Loanee farmers – Equivalent to the amount of loan availed. Non-loanee farmers –Upto value of 150 per cent of average yield. |

In case of loanee farmers-Equivalent to the ‘cost of cultivation’. Sum insured will be at least equal to amount of crop loan sanctioned/advanced. Non-loanee farmers -Equivalent to sum insured upto value of 150 per cent value of average yield. | Same as MNAIS | No improvement over MNAIS |

| Premium Rate |

Kharif season 3.5 per cent – Oilseeds and bajra 2.5 per cent – Cereals, millets & pulses Rabi season 1.5 per cent- Wheat 2 per cent –Other food and oilseeds crops Actuarial premium for Annual commercial/ horticultural crops |

Actuarial premium as well as net premium rates (premium rates actually payable by farmers after premium subsidy) for each notified crop through standard actuarial methodology in conformity with provisions of IRDA. | Maximum premium of 2 per cent of sum insured for Kharif (food & oilseed) crops.

1.5 per cent of sum insured for Rabi (food and oilseed) crops; and 5 per cent of sum insured for Annual commercial/ horticultural crops. |

The premiums to be paid by the farmers are significantly lower than the previous two schemes. |

| Subsidy | 10 per cent to small and marginal farmers only, to be shared equally between Centre and states. | Actual premium with subsidy upto 75 per cent to all farmers, to be shared equally between Centre and states. | The difference between the Actuarial Premium Rate (APR) and insurance charges payable by farmers shall be provided by Governments as subsidy and shall be shared equally by the Centre and states. | Significant improvement in subsidy offered over previous schemes. |

| Indemnity Level | Three level of indemnity – 90 per cent, 80 per cent and 60 per cent (low/medium/high risk areas) were available for all crops. The insured farmers may opt for higher level of Indemnity on payment of additional premium | The minimum Indemnity level increased to 70 per cent from 60 per cent from NAIS | 70 per cent, 80 per cent and 90 per cent based on the risks experiences and coefficient of variation in the past 10 years. | |

| Claims Liability | In case of food crops and oilseeds, claim liability of upto 100 per cent of premium collected was to be borne by the AIC. Thereafter, the Centre and state governments shared the liability equally. In the case of Annual commercial/horticultural crops, claim liability beyond 150 per cent of premium in the first three or five years and beyond 200 per cent thereafter, equally shared by Centre and state governments. | All claims were to be borne by the Implementing Agencies. To protect IAs, against overall loss exceeding 500 per cent of gross premium, a Catastrophe Fund at national level was to be set up with contribution of Centre and state governments | All claim liabilities on insurer and claim liability beyond 350 per cent of premium collected or 35 per cent of sum insured at national level to be shared equally by the Centre and state governments. | |

| Technology | Yield estimation through traditional CCEs. | Pilot studies for yield estimation through use of Remote Sensing Technology (RST). | Provision for adoption of RST, drone and other technologies in yield estimation and categorization of number of CCEs after validation by pilot studies. Use of Smartphone apps for accurate and fast transmission of CCE data to facilitate early settlement of claims. | The much-needed technology element is added in the PMFBY. |

Source: Report of CAG on Performance Audit of Agricultural Crop Insurance Scheme, 2017

Table 2: Challenges faced by the MNIAS/NAIS and PMFBY

| Parameter | NAIS/MNAIS | PMFBY | Challenge Faced |

| Farmers covered | Loanee and Non-loanee farmers, share croppers and tenants | Loanee and Non-loanee farmers, share croppers and tenants | Both the PMFBY and MNAIS fails to cover sharecroppers and tenants, despite government claiming that their coverage will be increased. |

| Risk covered | Yield risk and localised risk | Yield and localised risk | Yield loses cover under the MNAIS and PMFBY are same.Both the scheme faced the challenge of assessing loses due to localised calamity and the insurance companies are reluctant to investigate the crop losses due to these calamities and refuse to pay claims. This is making farmer losing interest in the scheme. |

| Insurance Unit | Village Panchayats, Blocks, Talukas | Village panchayats for major crops and Blocks for other crops | The PMFBY is an improvement over previous scheme. However, it fails to provide relief to the farmers as it does not cover losses arising out of a localised risk like wild animal attacks on individual farms. |

| Premium Rates | Premiums was calculated on actuarial basis (MNAIS). | 2% of sum insured for kharif. 1.5% for rabi and 5% for horticulture crops. |

In the PMFBY, the premiums for the farmers are kept low in order to attract more farmers. Despite this the farmers are not opting for the scheme. Delay in claims settlement is one of the major reason for it. The reason for delays in claim settlement are states unwillingness to pay high premiums. In the previous schemes, the farmers are not opting for the insurance due to higher burden of premiums. Now the same problem has been transferred to the states. It’s the exchequer who is facing the financial burden of high premium now. |

| Crop Cutting Experiments | Crop Cutting Experiments are used to assess yield losses. | Crop Cutting Experiment are used to assess yield losses. | Although the methodology to assess loses is same, the PMFBY has shifted the unit area from district/block level to village level.

As per rule, 24 CCE have to take place in a district and 16 CCE in a block for assessing the damage. Under the old schemes, there was a requirement of 1 million people to carry out CCE. However, after the new changes were made in PMFBY, a gram panchayat/village requires at least 4-5 such experiments to assess the crop damage. The process will require 4 million CCE and the same number people. Due to this there are delays in collecting CCE data and delays in claim settlement. |

| Sum Insured | Sum insured will be at least equal to the crop loans sanctioned.Non-loanee farmers -Equivalent to sum insured upto value of 150 per cent value of average yield. | Same as MNAIS | It has been observed in both the schemes that farmers are opting for sum insured equivalent to the loan amount only. In all such cases the insurance scheme is reduced to loan insurance scheme rather than a crop insurance scheme. |

(e) Technology missions and e-technology in the aid of farmers