CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

States vs Centre on Fuel Taxes

- IAS NEXT, Lucknow

- 02, May 2022

Why in news?

The Centre and the states are at loggerheads over taxes and duties on petrol and diesel.

What is the issue?

- As fuel prices soared in November 2021, the Centre, for the first time in over three years, cut central excise duties on petrol by Rs 5 per litre and diesel by Rs 10 per litre.

- 21 states then cut VAT in the range of Rs 1.80-10 per litre for petrol and Rs 2-7 per litre for diesel.

- As per the RBI’s State Finances report for 2021-22, the revenue loss to states due to this is estimated at 0.08% of GDP.

- The global oil prices have been at elevated levels since the time Russia invaded Ukraine due to which global oil supply halted.

- So, the relief measures that were provided were outweighed by a series of 14 price hikes in 16 days.

- The Centre feels that the states are not reducing VAT in line with the Centre’s cut in excise duty.

- But the states have expressed concerns over their fiscal cushion, especially with the GST compensation regime due to end in June.

Value-added tax (VAT) is a consumption tax on goods and services that is levied at each stage of the supply chain where value is added, from initial production to the point of sale.

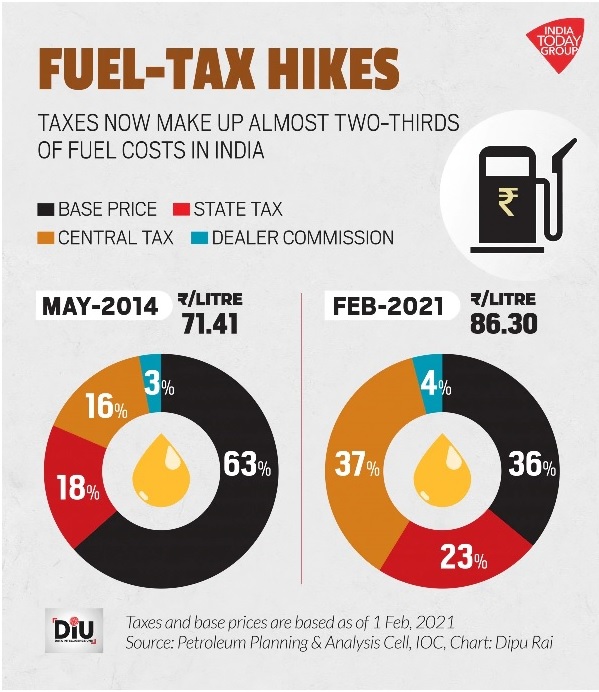

How significant is fuel taxes?

- Excise duty and VAT on fuel constitute an important source of revenue for both the Centre and the states.

- Excise duty on fuel makes up about 18.4% of the Centre’s gross tax revenues.

- Petroleum taxes with states are shared out of basic excise duty.

- The Centre also levies additional excise duty and cesses on petroleum products.

- Of the revenue receipts of states, central tax transfers comprise 25-29%, and own tax revenues 45-50%.

- Central and state taxes currently account for about 43% and 37% of the retail price of petrol and diesel respectively in Delhi.

How fuel is taxed?

The tax on fuel does not fall under the Goods and Services Tax (GST).

- Taxes on petrol and diesel are split into multiple components at the state and central level.

- States apply an ad valorem VAT or sales tax on the base price, freight charges, excise duty and dealer commission on petrol and diesel.

- While state VAT collections have risen along with higher fuel prices and previous hikes in excise duties, the states’ share of excise duties on fuel was reduced in the FY2022 Budget.

- Changes introduced

- The Basic Excise Duty (BED) on petrol and diesel was cut by Rs 1.6 and Rs 3 per litre respectively

- The special additional excise duty was cut on both by Rs 1 per litre

- An Agriculture Infrastructure and Development Cess (AIDC) of Rs 2.5 per litre on petrol and Rs 4 on diesel was introduced

- It reduced the states’ share as collections from cesses are not part of the shareable pool.

The Latin phrase ad valorem means “according to value.” All ad valorem taxes are based on the assessed value of the item being taxed.

What is the reason for variation in fuel prices?

- External factors- Since, the retail prices of petrol and diesel in India are linked to the international prices of crude oil, global crude oil prices plays a key role.

- Internal factors- Taxes and dealers’ commissions also impact the price of domestic petrol.

- Inter-regional variation– This difference in fuel retail prices is due to the different tax rates levied by the respective state governments on the same products.

- Freight charges depend upon the distance between the refining plant and the petrol pump; the farther is the petrol pump from the oil refining unit, the more is the freight charge.

- Because of this, the prices may vary from region to region.