CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

NEW UMBRELLA ENTITY (NUE)

- Vaid's ICS, Lucknow

- 24, Sep 2021

Why in News?

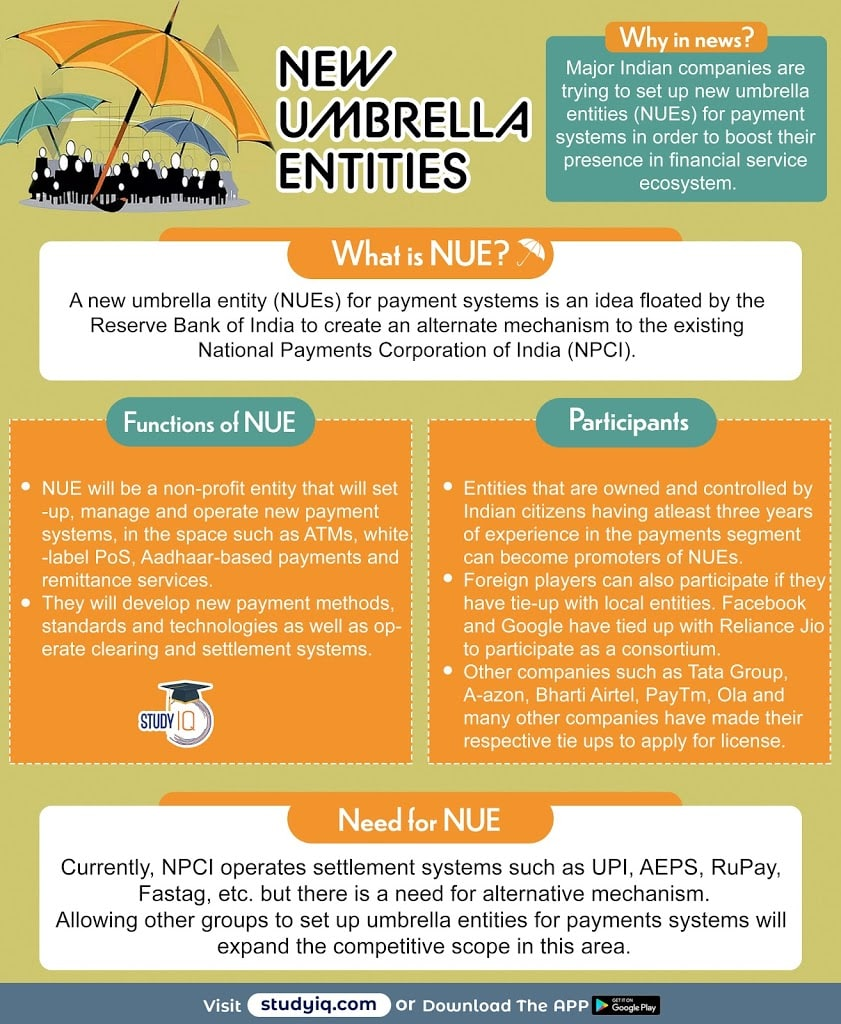

The private companies have shown interest in setting up New Umbrella Entities (NUEs) for payment systems – an idea floated by the Reserve Bank of India (RBI).

- The aim is to create an alternate mechanismto the existing National Payments Corporation of India (NPCI).

Key Points

New Umbrella Entities (NUEs):

About: NUEs will be a non-profit entity that will set-up, manage and operate new payment systems, especially in the retail space such as ATMs, white-label PoS; Aadhaar-based payments and remittance services.

Functions Envisaged:

- NUEs will develop new payment methods, standards and technologies.

- These will operate clearing and settlement systems, identify and manage relevant riskssuch as settlement, credit, liquidity and operation and preserve the integrity of the system.

- These will monitor retail payment system developments and related issuesin the country and internationally to avoid shocks, frauds and contagions that may adversely affect the system and the economy in general.

Need for NUEs:

- Limitations of NPCI:Currently, the umbrella entity for providing retail payments system is NPCI, which is a non-profit entity, owned by banks.

- NPCI operates settlement systems such asUPI, AEPS, RuPay, Fastag,

- Players in the payments space have indicated the various pitfalls of NPCI being the only entity managing all of retail payments systems in India.

To Increase Competitiveness: RBI’s plan to allow other organisations to set up umbrella entities for payments systems aims to expand the competitive landscape in this area.

- Players planning to establish these NUE aim to get an even bigger share in the digital payments sector.

Framework Related to NUEs:

Owned and Controlled by Residents: The promoter or the promoter group for the NUE should be ‘owned and controlled by residents’ with 3 years’ experience in the payments ecosystem.

- The shareholding pattern should be diversified.Any entity holding more than 25% of the paid-up capital of the NUE will be deemed to be a promoter.

- Capital: The umbrella entity shall have a minimum paid-up capital of Rs. 500 crore.

- No single promoter or promoter group should have more than 40% investment in the capital of the entity.

- A minimum net worth of Rs. 300 crore should be maintained at all times.

Facts for Prelims:

Vidyanjali portal

The Vidyanjali portal will enable community/volunteers to contribute by connecting directly with the government and government-aided schools of their choice.

According to education ministry, any person who is a citizen of India/NRI/PIO OR any organization/institution/company/group registered in India can volunteer and contribute in two ways:

- Services/activities• Assets/material/equipment such as basic civil infrastructure, basic electrical infrastructure, classroom support materials and equipment, digital infrastructure, equipment for extra curricular activities and sports, yoga, health, etc.

- Serving and retired teachers, scientist/government/semi government officials, retired armed forces personnel, self-employed and salaried professionals, alumni of educational institutions, homemakers and any other literate person can volunteer at a school that requests for assistance.

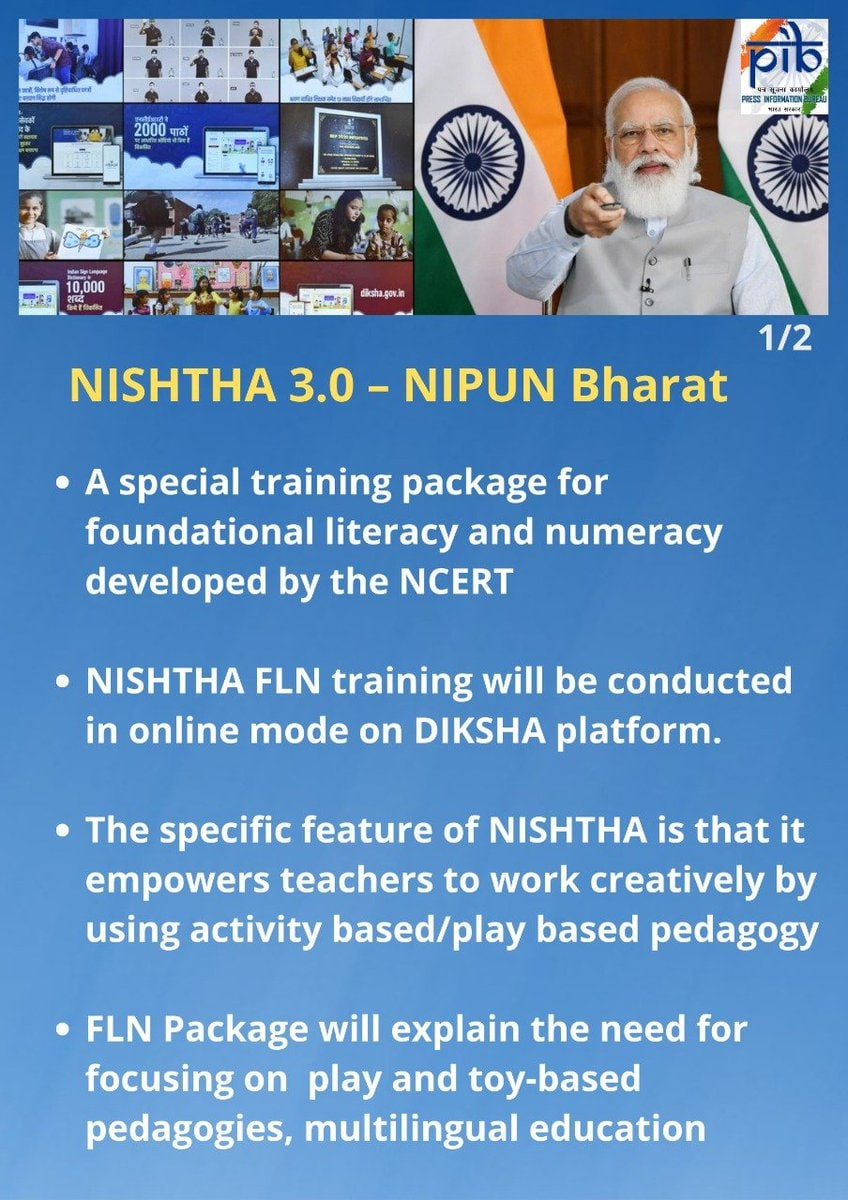

NISHTHA 3.0

- NISHTHA 3.0 under NIPUN Bharat is a platform that provides training to teachers on how to make education more enjoyable for a practical understanding.

- Around 25 lakh teachers will be benefitted and trained through NISHTHA