CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

National Financial Reporting Authority (NFRA)

- Vaid's ICS, Lucknow

- 17, Sep 2021

G.S. II

Context:

National Financial Reporting Authority (NFRA) Chairperson has pitched for a ‘standalone legislation’ for the regulator in the interests of autonomy.

He also demanded that all necessary penal provisions relating to financial reporting should be consolidated and vested with it.

Why this is necessary?

Currently, the NFRA may take action against auditors for professional misconduct but when it came to other functionaries of a company who have the responsibility for financial reporting, penal powers continue to be vested with the Centre. A standalone legislation will allow for integrated regulation of all participants in the financial reporting system.

About NFRA:

National Financial Reporting Authority (NFRA) was constituted on 1st October, 2018 under section 132 (1) of the Companies Act, 2013.

Why was it needed?

In the wake of accounting scams, a need was felt to establish an independent regulator for enforcement of auditing standards and ensuring the quality of audits so as to enhance investor and public confidence in financial disclosures of companies.

Composition:

The Companies Act requires the NFRA to have a chairperson who will be appointed by the Central Government and a maximum of 15 members.

Functions and Duties:

- Recommend accounting and auditing policies and standards to be adopted by companies for approval by the Central Government;

- Monitor and enforce compliance with accounting standards and auditing standards;

- Oversee the quality of service of the professions associated with ensuring compliance with such standards and suggest measures for improvement in the quality of service;

- Perform such other functions and duties as may be necessary or incidental to the aforesaid functions and duties.

Powers:

- It can probe listed companies and those unlisted public companies having paid-up capital of no less than Rs 500 crore or annual turnover of no less than Rs 1,000 crore.

It can investigate professional misconduct committed by members of the Institute of Chartered Accountants of India (ICAI) for prescribed class of body corporate or persons.

Facts for Prelims

Char Dham

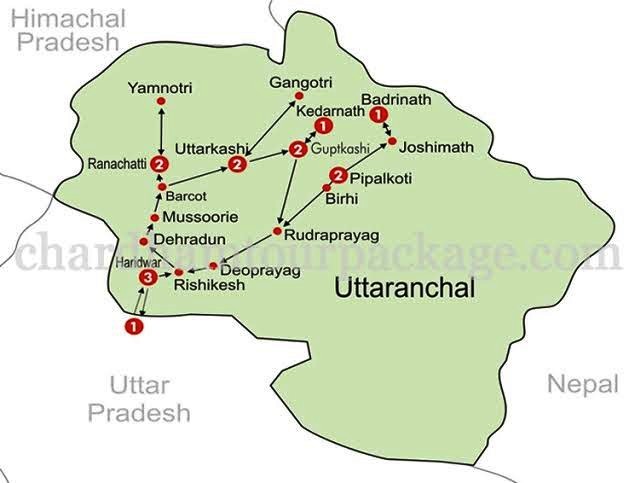

- Char Dham means Four Dhams i.e. Four religious places. Char Dham in Uttarakhand is a collective term used for religous circuit covering Holy hindu pilgrimage centres of Badarinath, Kedarnath, Gangotri and Yamunotri.

- All four temple shrines are located in Garhwal Himalayas range of Uttarakhand.

- This is considered as most sacred religious places to be visited by Hindus, to get rid of their sins and pave path to ultimate goal of human life – the Moksha.