CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Global Minimum Corporate Tax Rate framework deal

- Vaid's ICS, Lucknow

- 03, Jul 2021

Why in News?

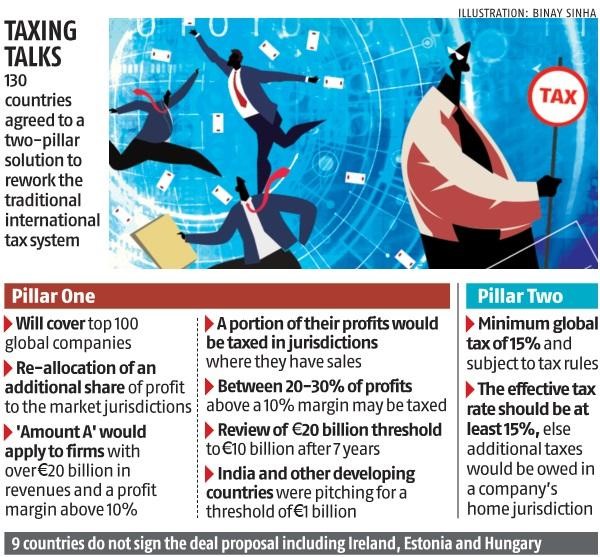

In a historic agreement, announced in Paris under the aegis of OECD, 130 countries (out of the 139 involved in talks), including India, have endorsed the OECD/G20 Inclusive Framework Tax Deal.

- It would be the most sweeping change in the international taxation in a century.

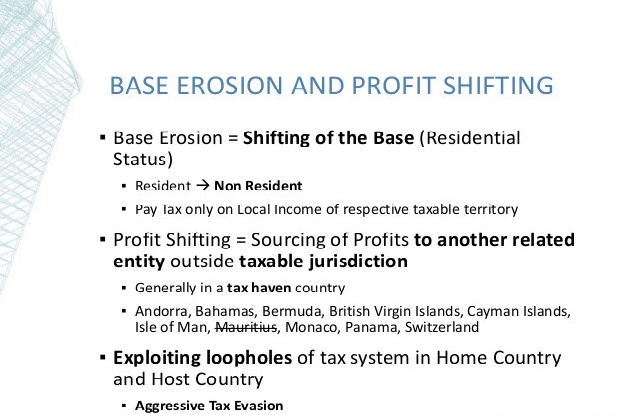

- This is part of the proposed OECD Base Erosion and Profit Shifting (BEPS) framework to rework the traditional international tax system to make digital firms pay taxes regardless of their physical presence or measured profits in a country.

- Once implemented, it is expected to prevent globally operating companies from shifting to low tax regions to secure extended profits.

- The G7 had already agreed on a minimum tax rate of at least 15%, in June 2021. The present deal has both elements of the agreement forged by the G7 in June. However, there are some special rules for certain sectors and companies added to it.

Countries which didn’t sign the deal:

A total of 130 countries have endorsed the deal. All major economies have signed up including many noted tax havens such as Bermuda, the Cayman Islands and the British Virgin Islands.

- The nine countries that did not sign were the low-tax EU members Ireland, Estonia and Hungary as well as Peru, Barbados, Saint Vincent and the Grenadines, Sri Lanka, Nigeria and Kenya.

Key elements of the tax Deal:

The proposed solution consists of two components:

- Pillar one, which is about reallocation of an additional share of profit to the market jurisdictions

- Pillar two consisting of minimum tax and subject to tax rules.

What are the new tax rules?

- The new minimum tax rate of at least 15% would apply to companies with turnover above a 750-million-euro ($889-million) threshold, with only the shipping industry exempted.

- Companies considered in scope would be multinationals with global turnover above 20 billion euros and a pre-tax profit margin above 10%, with the turnover threshold possibly coming down to 10 billion euros after seven years following a review.

- The minimum corporate tax does not require countries to set their rates at the agreed floor, but gives other countries the right to apply a top-up levy to the minimum on companies’ income coming from a country that has a lower rate.

Illustration: Country A has a corporate tax rate (CTR) of 20%, Country B has a CTR of 11% and Global minimum corporate tax (GMCT) rate is 15%. There is a Company X that is headquartered in Country A, but reports its income in Country B in order to save tax. Now with GMCT in place, country A can legally impose an additional top-up levy of 4% on Company X.

- Extractive industries and regulated financial services are to be excluded from the rules on where multinationals are taxed

- The deal resolves another issue by ensuring that Amazon.com Inc. will be subject to tax in local jurisdictions

Impact:

- Curb tax avoidance: Deal, after implementation, would curtail tax avoidance by making multinational companies pay an effective rate of “at least 15%” and give smaller countries more tax revenue from foreign firms.

- Discourage profit shifting: With a global minimum tax in place, multinational corporations will no longer be able to avoid paying their fair share by hiding profits in lower-tax jurisdictions.

- Without these new rules, the Biden administration’s planned tax increases could lead to companies relocating their headquarters to low-tax countries. With global minimum taxes, companies would have fewer options outside the U.S. to get lower rates, and that reduces the potential risks of raising taxes.

- Prevent countries from becoming tax havens: This would also discourage countries from lowering tax rates to very low levels, in order to attract business. Now, they would have to compete on other factors like ease of doing business, regulatory system, etc.

GS III

Why in News?

The Reserve Bank of India (RBI) recently launched its half-yearly Financial Stability Report.

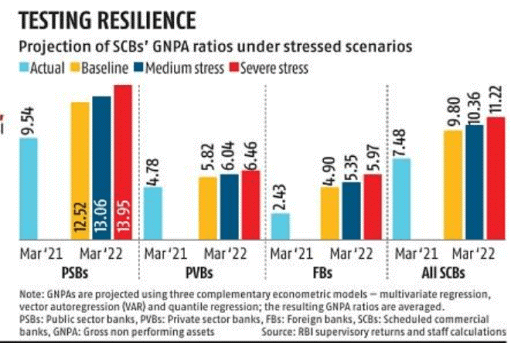

The report highlighted that the gross non-performing asset ratio (GNPA) of India’s scheduled commercial banks (SCBs) may climb by the end of the current fiscal year to as much as 11.2% under a severe stress scenario, from 7.48% in March 2021.

About the Financial Stability Report:

- The half-yearly FSR report is a collective assessment of the Financial Stability and Development Council (FSDC) sub-committee.

- It assesses the economy on risks to financial stability and the resilience of the financial system.

- All regulators take part in making the report, and it is released by the RBI.

Key highlights of the Financial Stability Report:

- The report mentions the “GNPA ratio of SCBs may increase by March 2022”. The report mentions that the banks have sufficient capital to take care of NPAs.

- The capital to risk-weighted assets ratio of SCBs increased to 16.03%, and the provisioning coverage ratio stood at 68.86% in March 2021.

- Policy support has helped in shoring up the financial positions of banks, containing non-performing loans, and maintaining solvency and liquidity globally.

- On the domestic front, the ferocity of the second wave of COVID-19 has dented economic activity. But the monetary, regulatory, and fiscal policy measures have helped curtail the solvency risk of financial entities, stabilize markets. Further, these measures also help the financial entities to maintain their financial stability.

- Large borrowers make up the lion’s share of a bank’s bad debt even now. The share of large borrowers in the aggregate loan portfolio of banks stood at 52.7 per cent in March 2021. But they accounted for 77.9 per cent of the total gross non-performing assets (NPA).

- The pandemic has hit consumers and smaller businesses the hardest. Demand for consumer credit across banks and non-banking financial companies (NBFCs) has dampened.

- Public sector banks grew their credit book by only 3.2 percent. On the other hand, private counterparts expanded their credit book by 9.9 per cent year on year.

Precautionary savings resulted in a deposit increase of 11.9 per cent.

- The report mentions new risks such as

- Future waves of the pandemic;

- Expansion of government market borrowing: The report has pointed out that banks are holding a high amount of government bonds. This is the highest since March 2010. This makes them sensitive to valuation changes.

- International commodity prices and inflationary pressures;

- Global spillovers amid high uncertainty;

- Rising incidence of data breaches and cyberattacks

- Improvement in health of banking sector: The RBI was expecting NPAs to climb to 12.5 per cent of advances under its baseline scenario a year ago. But under current projection’s it is what projected in a severe stress scenario also.

Suggestions mentioned in the report:

- The SCBs will need to reinforce their capital and liquidity positions to fortify themselves against potential balance sheet stress.

- The RBI also mentioned that the sustained policy support, benign financial conditions, and the gathering momentum of vaccinations were nurturing an uneven global recovery.

The IN-EUNAVFOR (Indian Navy – European Union Naval Force) Exercise is being conducted in the Gulf Of Aden for the first time.

About IN-EUNAVFOR Exercise:

The IN-EUNAVFOR exercise is being conducted for the first time.

Aim: To enhance and improve war-fighting skills. It also aims to promote their ability as an integrated force to promote peace, security and stability in the maritime domain.

Participants: Along with the Indian Navy, the other countries participating in the exercise are: Italy, Spain and France.

The exercise includes advanced air defence and anti-submarine exercises, tactical manoeuvres, Search & Rescue, and other maritime security operations.

From the Indian side, Stealth frigate INS Trikand is participating in the exercise.