CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Economic Survey 2021-22

- Vaid's ICS, Lucknow

- 02, Feb 2022

Why in News?

- Recently, the Union Minister for Finance & Corporate Affairs presented the Economic Survey 2021-22 in the Parliament.

What is the Economic Survey?

- It is an annual document prepared by the Department of Economic Affairs, the Ministry of Finance under the guidance of the Chief Economic Advisor.

- It is regarded as the official report card of the union government which gives a roadmap for the country’s economy and suggests a way forward.

- The survey was first published in 1950-51 and was initially part of the budget documents. The document was less than 50 pages in the 1950s and contained a brief outline of economic developments of the previous year.

- However, in a departure from recent years’ practice of the Survey being published in two volumes, the Economic Survey for 2021-22 has been published in a single volume.

- The various objectives of the Economic Survey in India can be summed up under three heads:

- Reviewing the country’s economic development over the past 12 months.

- Summarising how the different development projects of the country perform.

- Highlighting the government’s policy initiatives.

Major Highlights of the Economic Survey

Central Theme:

- The central theme of this year’s Economic Survey is the “Agile approach”, implemented through India’s economic response to the COVID-19 Pandemic shock.

- Another theme highlighted in this Economic Survey relates to the art and science of policy-making under conditions of extreme uncertainty.

Agile approach:

- Agile framework is based on feed-back loops, real-time monitoring of actual outcomes, flexible responses, safety-net buffers and so on.

- It is much needed because of the explosion of real-time data that allows for constant monitoring. Such information includes GST collections, digital payments, satellite photographs, electricity production, cargo movements, internal/external trade, infrastructure roll-out etc.

State of the Economy:

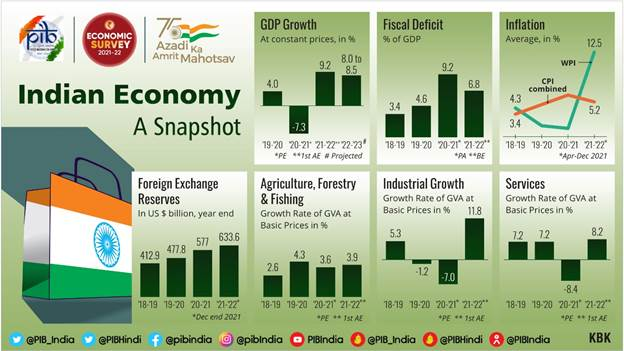

- The Indian economy is estimated to grow by 9.2 per cent in real terms in 2021-22 (as per first advance estimates) subsequent to a contraction of 7.3 per cent in 2020-21.

- Growth Outlook: GDP is projected to grow by 8- 8.5 per cent in real terms in 2022-23.

- The year ahead is poised for a pickup in private sector investment with the financial system in a good position to provide support for the economy’s revival.

Comparison with other agencies estimates:

- Projection is comparable with the World Bank and Asian Development Bank’s latest forecasts of real GDP growth of 8.7 per cent and 7.5 per cent respectively for 2022-23.

- As per IMF’s latest World Economic Outlook projections, India’s real GDP is projected to grow at 9 per cent in 2021-22 and 2022-23 and at 7.1 per cent in 2023-2024, which would make India the fastest-growing major economy in the world for all 3years.

- The economic impact of the “second wave” was much smaller than that during the full lockdown phase in 2020-21, though the health impact was more severe.

- Government’s Response: The government of India’s unique response consisted of safety-nets to cushion the impact on vulnerable sections of society and the business sector, significant increase in capital expenditure to spur growth and supply-side reforms for a sustained long-term expansion.

- The government’s flexible and multi-layered response is partly based on an “Agile” framework that uses feedback-loops, and the use of eighty High-Frequency Indicators (HFIs) in an environment of extreme uncertainty.

Fiscal Developments:

- The revenue receipts from the Central Government (April to November 2021) have gone up by 67.2 per cent (YoY) as against the expected growth of 9.6 per cent in the 2021-22 Budget Estimates (over 2020-21 Provisional Actuals).

- Gross Tax Revenue registers a growth of over 50 per cent from April to November 2021 in YoY terms.

- This performance is strong compared to pre-pandemic levels of 2019-2020 also.

- During April-November 2021, Capex has grown by 13.5 per cent (YoY) with a focus on infrastructure-intensive sectors.

- The banking sector is well placed to support the economy, as it is now “well capitalised and the overhang of Non-Performing Assets seems to have structurally declined”.

- Buoyant tax revenues and government policies have created “headroom for taking up additional fiscal policy interventions” and Stressed the need to continue the focus on capital expenditure.

- It has indicated that the government is on course to achieve the fiscal deficit target of 6.8% of GDP for the current year.

- Sustained revenue collection and a targeted expenditure policy have contained the fiscal deficit for April to November 2021 at 46.2 percent of BE.

- Debt: With the enhanced borrowings on account of COVID-19, the Central Government debt has gone up from 49.1 percent of GDP in 2019-20 to 59.3 percent of GDP in 2020-21 but is expected to follow a declining trajectory with the recovery of the economy.

Monetary Management and Financial Intermediation:

- The liquidity in the system remained in surplus. Repo rate was maintained at 4 per cent in 2021-22.

- Measures Of RBI: RBI undertook various measures such as G-Sec Acquisition Programme and Special Long-Term Repo Operations to provide further liquidity.

The economic shock of the pandemic has been weathered well by the commercial banking system:

- YoY Bank credit growth accelerated gradually in 2021-22 from 5.3 per cent in April 2021 to 9.2 per cent as of 31st December 2021.

- The Gross Non-Performing Advances ratio of Scheduled Commercial Banks (SCBs) declined from 11.2 per cent at the end of 2017-18 to 6.9 per cent at the end of September 2021.

- Net Non-Performing Advances ratio declined from 6 per cent to 2.2 per cent during the same period.

- The capital to risk-weighted asset ratio of SCBs continued to increase from 13 per cent in 2013-14 to 16.54 per cent at the end of September 2021.

- The Return on Assets and Return on Equity for Public Sector Banks continued to be positive for the period ending September 2021.

Sustainable Development and Climate Change:

- India’s overall score on the NITI Aayog SDG India Index and Dashboard improved to 66 in 2020-21 from 60 in 2019-20 and 57 in 2018-19.

- The number of Front Runners (scoring 65-99) increased to 22 States and UTs in 2020-21 from 10 in 2019-20.

-

- In North-East India, 64 districts were Front Runners and 39 districts were Performers in the NITI Aayog North-Eastern Region District SDG Index 2021-22.

- Forest area:

- India has the tenth largest forest area in the world.

- In 2020, India ranked third globally in increasing its forest area from 2010 to 2020.

-

-

- In 2020, the forests covered 24% of India’s total geographical area, accounting for 2% of the world’s total forest area.

-

-

-

-

- The top 10 countries account for 66% of the world’s forest area. Of these, Brazil (59%), Peru (57%), the Democratic Republic of Congo (56%) and Russia (50%) have half or more of their total geographical area under forests.

-

-

- Governments initiatives: In August 2021, the Plastic Waste Management Amendment Rules, 2021, was notified which is aimed at phasing out single-use plastic by 2022.

- Draft regulation on Extended Producer Responsibility for plastic packaging was notified.

- The Compliance status of Grossly Polluting Industries (GPIs) located in the Ganga main stem and its tributaries improved from 39% in 2017 to 81% in 2020.

- The consequent reduction in effluent discharge has been from 349.13 million litres per day (MLD) in 2017 to 280.20 MLD in 2020.

- The Prime Minister, as a part of the national statement delivered at the 26th Conference of Parties (COP 26) in Glasgow in November 2021, announced ambitious targets to be achieved by 2030 to enable further reduction in emissions.

- The need to start the one-word movement ‘LIFE’ (Lifestyle for Environment) urging mindful and deliberate utilization instead of mindless and destructive consumption was underlined.

Agriculture and Food Management:

- The Agriculture sector experienced buoyant growth in the past two years, accounting for a sizable 18.8% (2021-22) in Gross Value Added (GVA) of the country registering a growth of 3.6% in 2020-21 and 3.9% in 2021-22.

- Minimum Support Price (MSP) policy is being used to promote crop diversification.

- Net receipts from crop production have increased by 22.6% in the latest Situation Assessment Survey (SAS) compared to the SAS Report of 2014.

- Allied sectors including animal husbandry, dairying and fisheries are steadily emerging to be high growth sectors and major drivers of overall growth in the agriculture sector.

- The Livestock sector has grown at a CAGR of 8.15% over the last five years ending 2019-20.

-

- It has been a stable source of income across groups of agricultural households accounting for about 15% of their average monthly income.

- Steps: Government facilitates food processing through various measures of infrastructure development, subsidized transportation and support for the formalization of micro food enterprises. India runs one of the largest food management programmes in the world.

- The government has further extended the coverage of food security networks through schemes like PM Gareeb Kalyan Yojana (PMGKY).

- The Centre has distributed 3.38 lakh metric tonnes of fortified rice till December 2021 through anganwadis and mid-day meals at government schools.

-

-

- The Government has started distributing fortified rice under the Integrated Child Development Scheme and PM Poshan schemes across the country during 2021-22 in an effort to scale up the distribution of fortified rice in the country to fight malnutrition and micronutrient deficiencies among pregnant women, lactating mothers, children etc.

- Sugar mills’ sale of ethanol to oil marketing companies helped them earn additional revenue and clear cane price arrears to farmers.

- India is the largest consumer and the second-largest producer of sugar in the world.

-

Services:

- GVA of services crossed pre-pandemic level in July-September quarter of 2021-22; however, GVA of contact intensive sectors like trade, transport, etc. still remain below pre-pandemic level. Overall service Sector GVA is expected to grow by 8.2 per cent in 2021-22.

- During the first half of 2021-22, the service sector received over US$ 16.7 billion FDI – accounting for almost 54 per cent of total FDI inflows into India.

Facts for Prelims :

Nal Se Jal Yojana:

An allocation of Rs 60,000 crore has been made to cover 3.8 crore households in 2022-23 under Har Ghar, Nal Se Jal scheme.

Nal Se Jal Yojana:

Launched in 2019.

Nodal Agency: Ministry of Jal Shakti

- Aim: To provide piped drinking water to every rural home by 2024

- It is a component of the government’s Jal Jivan Mission.

Implementation:

- The scheme is based on a unique model where paani samitis (water committee) comprising villagers will decide what they will pay for the water they consume.

- The tariff they fix will not be the same for everyone in the village. Those who have large households will pay more, while poor households or households where there is no earning member, will be exempted.