CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Corporates to set up banks- Issues related

- IAS NEXT, Lucknow

- 29, Nov 2021

Context:

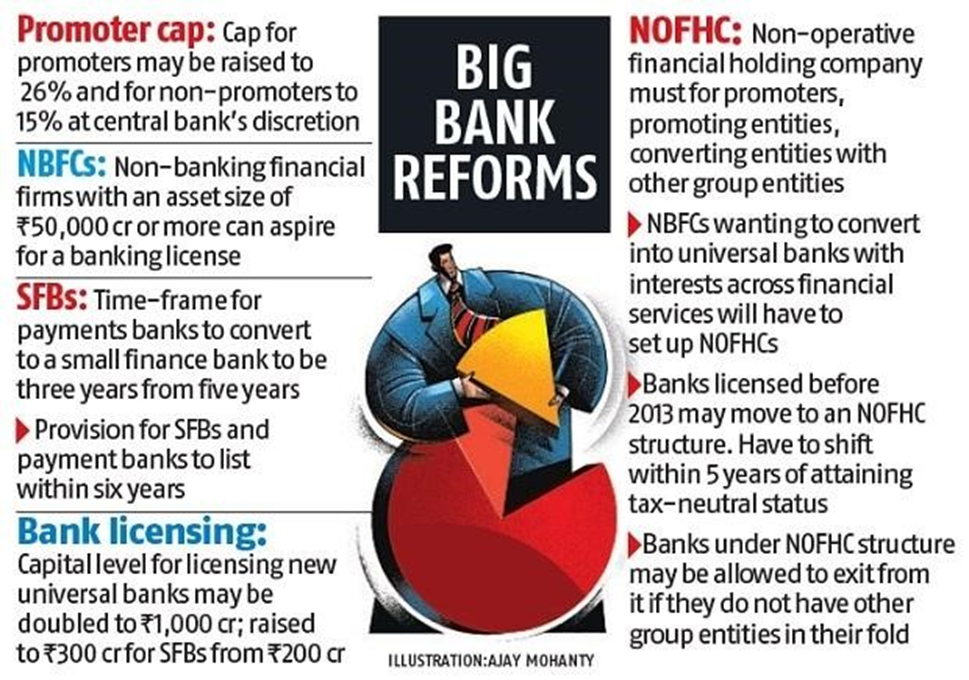

The Reserve Bank of India (RBI) has kept in abeyance a recommendation by an internal panel to give banking licences to large business groups, while allowing promoters to own up to 26% in private banks.

What has happened?

The IWG was constituted to “review extant ownership guidelines and corporate structure for Indian private sector banks” and submitted its report last week.

- One key recommendation of the group was related to allowing large corporate/industrial houses to be promoters of private banks.

What’s the issue now?

Former RBI Governor Raghuram Rajan and former RBI Deputy Governor Viral Acharya have criticised the suggestion by the IWG, describing it a “bombshell”.

- They observed, it would be ‘penny wise pound foolish’ to replace the poor governance under the present structure of these (public sector/government-owned) banks with a highly conflicted structure of ownership by industrial houses.

Why is the recommendation to allow large corporates to float their own banks being criticised?

Historically, RBI has been of the view that the ideal ownership status of banks should promote a balance between efficiency, equity and financial stability.

- A greater play of private banks is not without its risks. The global financial crisis of 2008 was a case in point.

- A predominantly government-owned banking system tends to be more financially stable because of the trust in government as an institution.

- More specifically, here in this case, the main concern in allowing large corporates to open their own banks is a basic conflict of interest, or more technically, “connected lending”.

What is connected lending?

A situation where the promoter of a bank is also a borrower and, as such, it is possible for a promoter to channel the depositors’ money into their own ventures.

- Connected lending has been happening for a long time and the RBI has been always behind the curve in spotting it.

- The recent episodes in ICICI Bank, Yes Bank, DHFL etc. were all examples of connected lending.

- The so-called ever-greening of loans (where one loan after another is extended to enable the borrower to pay back the previous one) is often the starting point of such lending.