CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

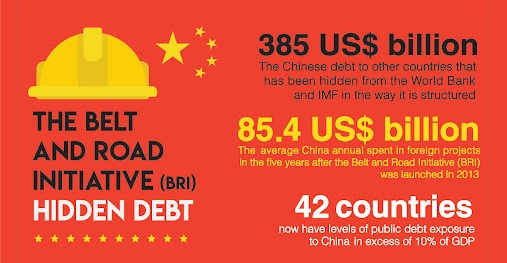

Hidden debt rising for partners of China’s BRI plan

- Integrity Education, Delhi

- 01, Oct 2021

- A new study has found under-reported debts to the tune of $385 billion in projects carried out in dozens of countries under China’s Belt and Road Initiative (BRI)

- The rise in “hidden” debt is on account of an increasing number of deals struck not directly between governments but structured through often opaque arrangements with a range of financing institutions.

- The study by AidData, a development research lab at the College of William & Mary in the U.S., found that 42 countries now have levels of public debt exposure to China in excess of 10% of GDP.

- India ranked 23rd in the list of top recipients of Chinese loans from 2000 to 2017, receiving $8.86 billion

- The total debt, the study added, was “systematically under-reported to the World Bank’s Debtor Reporting System (DRS) because, in many cases, central government institutions in LMICs (low and middle income countries) are not the primary borrowers responsible for repayment”

- The big difference between China and other prominent sources of overseas financing was that Chinese banks have used “debt rather than aid to establish a dominant position in the international development finance market”.

- Countries such as Nepal and Sri Lanka turned to Chinese loans at higher interest rates because of the lack of financing options elsewhere for infrastructure projects.

- The other change with the BRI is the rising number of “mega projects” (worth $500 million or more), which has prompted Chinese banks to work through lending syndicates and financing arrangements to share the risk.